What is a Lien?

A lien is a legal claim against property, or right to property, for the purpose of securing payment of a debt. Liens are public records that are filed with the office of the county clerk.

Liens are powerful tools for the purpose of putting pressure on owners and contractors for funds owed to their contractors and subcontractors. Liens prevent the sale of property until the debt is paid. Perhaps even more importantly, a valid lien creditor is able to foreclose on and take possession of property encumbered by a lien.

Types of Liens

a. Mechanic’s and Materialman’s (Statutory) Lien

A mechanic’s and materialman’s lien (“Statutory Lien”) is a traditional lien that secures payments for amounts owed for improvements made to real property. A Statutory Lien is available for both original contractors (defined below) and subcontractors to secure payments owed and outstanding for work they completed at a property. A Statutory Lien is filed against the property where the original contractor/subcontractor performed work at/on.

b. Constitutional Liens

In addition to being eligible to file a statutory lien, original contractors are also entitled to a constitutional lien for amounts owed by the owner of a project. Under Section 37 of Article XVI of the Texas Constitution, contractors who perform work directly for an owner of real property for the improvement of that property are entitled to a constitutional lien. The eligibility requirements for filing a constitutional lien differ from that for a statutory lien in that it is only available to original contractors, and not to subcontractors.

Procedures for Filing and Perfecting a Mechanic’s Lien

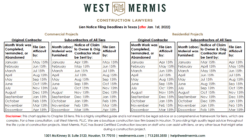

*The deadline to do so will depend on (a.) the type of construction project (residential or commercial) and (b.) the type of lien.

Dates and Deadlines for Filing

Dates and deadlines for filing and enforcing a lien are different for “residential properties” and “commercial properties,” which are defined particularly and vary from the colloquial definition. A “residential property” is defined as a single-family home, duplex, triplex, quadruplex, or unit a multi-unit structure that is used for residential purposes and that is (1) owned by one or more adult persons (NOT: entities), and (2) is used or intended to be used a dwelling by one of the property owners. A “commercial property” is defined as any property that does not fall under the residential property definition.

Thus, a single-family home that is currently owned by the builder would be a commercial property. On the other hand, once it is sold to a family who lives (or intends to live) at the home, then it becomes a residential property. Regardless of whether a project is considered to be commercial or residential, the deadline for filing a lien affidavit and sending a notice of claim will depend on the month in which the last work was completed, or otherwise when the project was terminated or abandoned.

Dates and Deadlines for Foreclosure Actions (Statutes of Limitation)

a. Statutory Liens

i. Contracts entered into after 1/1/2022: within 1 year of the deadline for filing a lien affidavit.

ii. Commercial contracts entered into before 1/1/22: either within 2 years of the lien affidavit filing deadline or within 1 year of terminating, completing, or abandoning the project, whichever is the later occurrence.

iii. Residential contracts entered into before 1/1/2022: either within 1 year of the lien affidavit filing deadline or within 1 year of terminating, completing, or abandoning the project, whichever is the later occurrence.

b. Constitutional Liens: 4 years

What is a Bond?

A bond is a form of insurance policy that allows project owners, developers, contractors, and subcontractors to enter contracts and perform without the fear of default leading to the inherent risk of not being paid or having work performed.

Types of Bonds

a. Payment Bonds

Payment Bonds are a form of assurance for original contractors and subcontractors that provides them peace of mind with regards to receiving payments. A Payment Bond guarantees that party pay all entities involved in a particular project when it is completed.

Overall, in order to be valid, a payment bond must be (1) in the penal sum of the contract amount, (2) be in favor of the property owner, (3) endorsed by the surety, property owner, and prime contractor, (4) be conditional upon prompt payment of all claims, and (5) the surety contact information.

b. Performance Bonds

Performance Bonds are a form of assurance for project owners that provides them with peace of mind on completing a project. A performance bond is a type of surety bond that guarantees a contractor will complete a construction project in accordance with the agreed-upon contract terms and specifications. A surety company issues a performance bond and guarantee

A subcontractor performance bond is a type of performance bond available to general and higher-level contractors to secure performance by their subcontractors.

Procedures for Filing Claim

Regardless of whether you are filing a claim against a payment bond or performance bond, the requirements largely mirror each other. When a claim is made, a surety company that issues the bond will conduct an investigation to determine whether both the obligee and the principal fulfilled their obligations under an agreement and thus whether a claim is valid. The surety does this by ensuring that three conditions have been met: (1) the obligee has submitted, in writing, an official claim that a principal violated the terms of the agreement (2) the principal indeed violated the terms of the agreement, and (3) the obligee has lived up to their end of the agreement.

The procedures to file and perfect a claim on a payment or performance bond largely mirror those of a statutory lien, and follow the deadlines for the same. One important caveat to this pattern is the lack of affidavit requirement. Nonetheless, for original contractors and owners, a valid payment or performance bond must be recorded in the real property records, along with the prime contract, to preclude any mechanic’s liens from being filed against the property. Unpaid subcontractors and suppliers have this option as well for payment bonds, but they also may timely assert a claim directly against a bond as well.

Dates & Deadlines

As previously explained, the dates and deadlines for filing a claim against a payment or performance bond mirror those of filing and perfecting a statutory mechanic’s lien. Similarly to with a statutory mechanic’s liens, these deadlines vary depending on whether the underlying contract is for the construction or improvement to a residential property or a commercial property.

Liens, bonds, and the dates to remember can be complex. When in doubt, don’t hesitate to contact us at West Mermis for a free consultation.

Nicolas Meade is a litigation associate with West Mermis PLLC. He provides legal advice and counsel to members of the construction industry and assists on complex construction disputes involving homeowners, general contractors, subcontractors, and insurance companies.